Media & Blog

Use the filters to find what you are looking for.

You might think property, like everything else in Melbourne, is locked down. But the sales of Melbourne homes are powering ahead and as the market opens up, it promises to get even hotter.

Quite the opening line isn’t’ it! It’s about the flood of FAKE and bogus Buyers Agents still entering the sector and the huge risks to consumers. The 'PIG' I refer to are people who have entered the sector after being marketed to during ‘wealth creation seminars or Facebook ads, promoting this career pivot to ‘get rich quick’, on the backs of consumers.

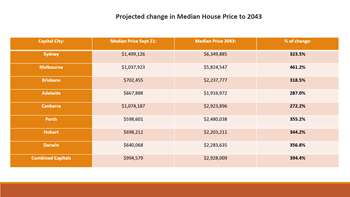

House price data for the year to July was released on Monday and for property tragics like me, it proved a fascinating read. The overall picture is remarkably rosy, with CoreLogic showing Melbourne house prices rising 10.4% for the year. That was against a backdrop of the best performance in Australian property in 17 years.

Election shock results “The re-election of the Coalition government has cleared the way for investors to come back into the market. The near miss of Labor being elected and their negative gearing and capital gains tax property policies being implemented goes to show that investors shouldn’t rest on their laurels and assume that they can take their time when it comes to entering into the property market. The current tightening of bank lending policies also highlights that inaction can cost opportunity altogether for buyers who are slow to take action. As I always say, the best time to buy property is when the bank will lend you the money. From there it about making a smart decision and buying the right property, in the right location, with the right attributes for growth , at the right price. That’s where we can help !

Property had a stellar year in 2021 with Melbourne values soaring 15.1% for the year; 22.1% nationwide. But at the end of the year, some statistics showed a slowing, leaving commentators suggesting the dream run was over. So, is it? We think that pessimism is misplaced with the market likely to record solid if somewhat unsexy growth in 2022. But there are signs you should look for to see how the market is travelling.

I have recently been engaged by clients to source, investigate and secure for them a home in the northern Melbourne suburbs. They are wanting a home that has potential for a good renovation in order to add value to their property. With the Brief and Budget locked in, I have now commenced the process of identifying suitable Investment Grade property options.

Multi award-winning REBAA member Miriam Sandkuhler from Property Mavens has started welcoming franchisee start-ups, saving entrants the hassle of setting up a business, including all administration systems and building a brand themselves.

The number of properties for sale is building as tree changers and sea-changers put suburban houses on the market to fund their lifestyle move.

As buyers advocates in Melbourne we understand how damaging too much information can be, that's why we simplify the process for you. Call us today to find out more

I have always been a passionate consumer advocate when it comes to real estate buying. I initiated and continued the media campaign and lobbying government against underquoting in 2014 for 2 years, to finally see legislated changes implemented in 2017 and then revised in 2019.

There are several frustrations that buyers commonly experience when purchasing a property which include: Limited Listings/Stock Levels: One of the most common frustrations for buyers is limited listings. In a competitive market, there may be few properties available that meet the buyer's criteria, leading to a longer search process and potentially settling for a property that isn't their first choice.

The Rise of the Fake Buyers agent and what consumers need to know Have you noticed over the last decade or so that buyers agents have risen from an unknown profession to a name on every property buyers lips?

I recently spoke to a prospect who was comparing our buyer’s agency service and price to two other competitors. All 3 of us were established, reputable, skilled, very experienced, and worthy of engaging, so it was a fair comparison. And yes, there was some variation in our fees.

At Property Mavens we understand risk and how to mitigate it for our clients when buying property in Melbourne and surrounds. Call us to find out how we can help

No nasties for investors. It goes without saying, negative gearing and capital gains tax concessions were unaffected by this year’s budget. It’s safe to say, any changes to tax and property ownership would cause a political earthquake which no politician wants.

It was all going so well and then, like a bad dream, we’re back in lockdown. Frustrating for sure, but I see this as a short distraction for home buyers and investors.

With the Australian property market having a stellar performance throughout 2021, first time Property Investors are now looking at 2022 and deciding where to invest. After attending an online Property webinar yesterday, hosted by Hotspotting’s, Terry Ryder, with a panel of various property experts including our CEO Miriam Sandkuhler , it is clear that South East Queensland is a favoured location. And by all accounts the South East Queensland property market should be one of the stand out performers for 2022.